by Jon Forrest Little

Electric Royalties (Ticker Symbol ELECF in the U.S. and ELEC in Canada)

web :: https://www.electricroyalties.com/

Yesterday, we wrote about how much metal it will take to transition to Net Zero and/or phase out the internal combustion engine.

Here was that article

We also learned (At Princeton Pickaxe University) the internal combustion engine is not going anywhere anytime soon.

Like it or not, there is a push toward Net Zero, but smart money states we will need a combination of electric, fossil fuels, renewables, and nuclear.

It's all oars in the ocean for forward propulsion

Yesterday, we established that even the preference for renewables, by definition, necessitates the intensive use of fossil fuels.

Western thinking often traps us into thinking it is "this or that" when it is really "this and that."

Here are some specific examples of how oil and diesel are used in mining operations (mining the metals needed for the "green economy."

Oil-powered drilling rigs drill holes for exploration, production, and water wells. They are also used to drill blast holes, which are used to break up rock and minerals.

Oil or diesel-powered crushers break down large rocks and minerals into smaller pieces. This is done in preparation for further processing or transportation.

Oil and diesel power the equipment to refine minerals into their final products. This equipment includes flotation machines, concentrators, and smelters.

Diesel-powered trucks, ships, and trains transport mined materials from the mine site to processing facilities and other locations. This can be a long-distance haul, so it is vital to use a fuel that is efficient and reliable.

Generators provide electricity to mine sites, especially those in remote areas.

Oil and diesel fuel various mining machinery, such as loaders, excavators, and bulldozers.

Oil and diesel also heat and cool buildings and equipment on mine sites.

What are the metals most necessary to Electrify our lives?

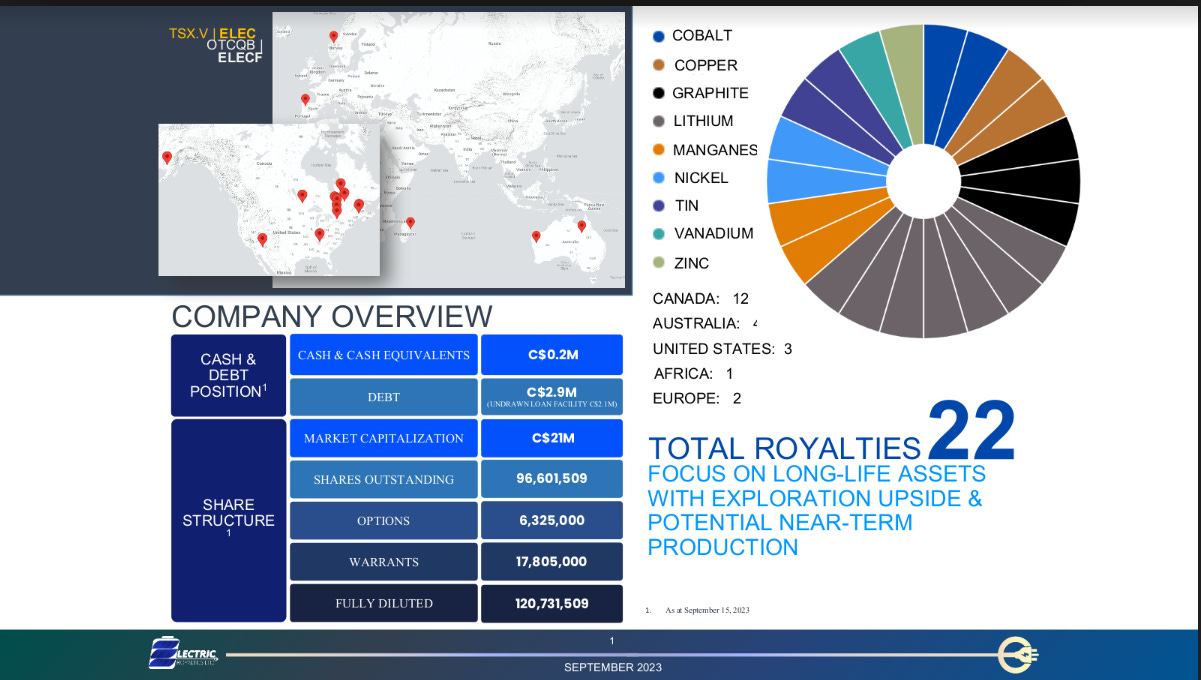

Electric Royalties (Ticker Symbol ELECF in the U.S. and ELEC in Canada) is a one-stop shop to get exposure to a significant new trend and is the only public company with exposure to the nine essential metals necessary for the electrification of the economy.

To begin with, here's why we like the royalty model so much -- and why even a small company like Electric Royalties is more diversified than other types of companies of its size.

A royalty company's role – once royalty rights are secured, and the operating mine digs up the metals – is to collect royalty checks on behalf of its shareholders.

Such companies do not actually own stock in the mining companies it invests in... Instead, they own a deeded interest in the very metal deposit itself and the right to cash flow a mine produces over time. They do not own mines, lease mining equipment, or employ miners either. Consequently, they do not bear the high inflation or energy costs involved in operating a mine. Nor are they on the hook for additional capital to build or run any mine, and they don’t have to contend with sticky political or environmental challenges like the actual mine operators so often do.

That's why royalty companies have generally outperformed investments made directly in the shares of operating mining companies, exploration companies, or the underlying commodities associated with them. As a result, there also tends to be less volatility and risk in holding royalty company shares.

The royalty model proved itself in the precious metals sector (gold, silver, etc.) starting back in the 1980s. But interestingly, royalties have barely been "a thing" with respect to other metals… until now.

Electric Royalties is now applying this same time-tested royalty model in mining with nine metals – lithium, cobalt, copper, nickel, tin, graphite, manganese, zinc, and vanadium – that are absolutely essential to the electrification of the global economy.

Investors have an opportunity to position now, before the stampeding herd.

Electric Royalties Ltd.’s (Ticker Symbol ELECF in the U.S. and ELEC in Canada) portfolio of mining royalties captures all nine metals key to the new Electric Economy. Here's how this royalty company works:

1. Electric Royalties raises and invests capital in providing essential funding for well-managed mining projects in politically stable, mineral-rich regions.

2. In exchange for this funding, Electric Royalties secures deeded interests in perpetuity to a percentage of the metals in the ground. Royalties are paid when metals are extracted and brought to market. These royalties are paid to Electric Royalties for the life of the mine, typically decades.

3. Electric Royalties does not assume the liabilities and risks associated with traditional mining operations – administrative, environmental, political, payroll, transportation, smelting, etc.

Take lithium, for example. It's just 1 of the 9 metals on Electric Royalties’ target list, although the company's existing portfolio is about 35% lithium. The lithium supply / demand scenario has similarities across most of these metals.

Lithium facts:

The cost of lithium has risen from $6,000 per tonne in 2020 to $78,032 a tonne in 2022, a 13-fold increase in less than two years.

Lithium demand is expected to rise from 500,000 tonnes of lithium carbonate equivalent (LCE) in 2021 to somewhere between three million and four million tonnes in 2030.

Demand for lithium is projected to grow ~x 40 by 2040.

Within Electric Royalties' current portfolio of 22 royalties, there are two producing (Middle Tennessee Zinc Mine and Penouta Tin-Tantalum Mine) currently and numerous projects expected to start producing within the next three years. The company is expected to enjoy $10 million or more in annual royalty payments by 2026, assuming no additional royalties are acquired.

Here's a breakdown of the current and near-term royalties:

Middle Tennessee Zinc Mine -- This is a sliding scale Gross Mining Royalty (GMR) above US$0.90/lb zinc prices. Mine located in the United States and operated by Nyrstar / Trafigura.

Penouta Tin-Tantalum Mine – This is a 1.5% Gross Revenue Royalty (GRR). Mine located in Spain and operated by Strategic Minerals Europe Corp.

Authier Lithium -- This is a 0.5% GMR. Located in Canada and operated by Sayona Mining.

Graphmada Graphite -- This is a 2.5% Net Smelter Royalty (NSR). Located in Madagascar and operated by Greenwing Resources.

Bissett Creek Graphite -- This is a 1% GRR. Located in Canada and operated by Northern Graphite.

Zonia Copper -- This is a 0.5% GRR with an option to add an additional 0.5% GRR. Located in the United States and operated by World Copper.

Battery Hill Manganese – This is a 2% GMR. Located in Canada and operated by Manganese X Energy Corp.

Mont Sorcier Vanadium -- This is a 1% GMR. Located in Canada and operated by Cerrado Gold.

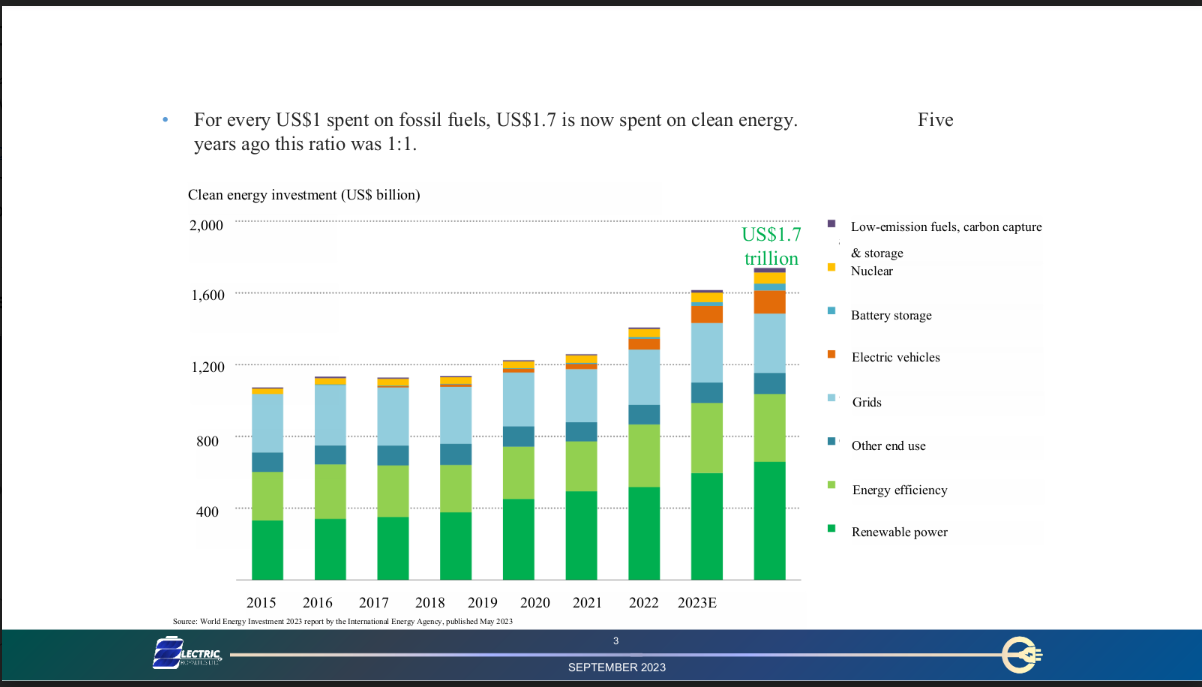

The transition to Net Zero is happening, and it's happening fast.

In 2021, the IEA published its Net Zero by 2050: A Roadmap for the Global Energy Sector, which sets out an ambitious

pathway for the global energy sector to reach net zero emissions by 2050.

Like it or not, most of the G20 are adopting large swaths of

these IEA initiatives. Even global energy companies are jumping on the electric bandwagon.

BP's spokesperson stated the International Energy Agency's recent report on reaching net-zero emissions by 2050 as well aligned with BP's decarbonization strategies. "In many ways is consistent with what we're doing with the company."

BP's plans to “reduce oil and gas production by 40% in the next decade and they are busy re-arranging their business goals and strategy to profit from this transition to Net Zero.”

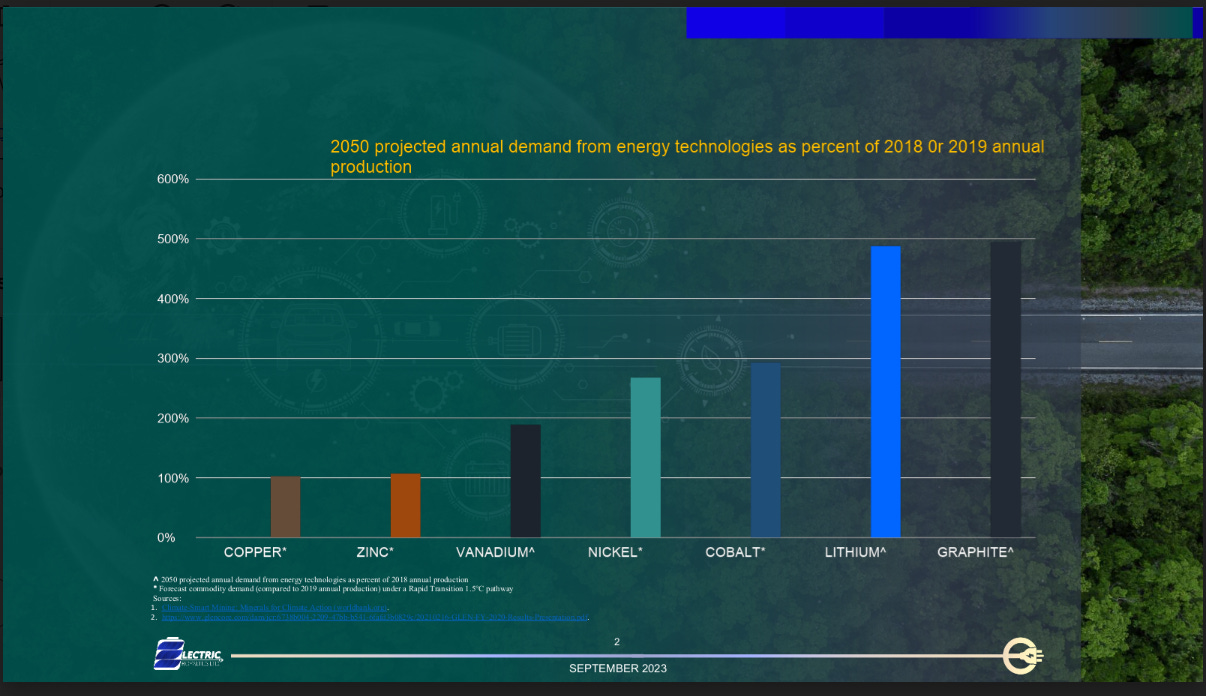

As we reported last month, here is how much metal is needed to comply with IEA standards.

For copper, 6,700 million tonnes are needed. In 2019, 20.4 million tonnes of copper were produced. So it would take 328 years (using 2019 copper production numbers as a baseline) to reach the required copper amount needed to phase out fossil fuels.

For nickel, 1,352 million tonnes are needed. In 2019, 2.61 million tonnes of nickel were produced. So it would take 518 years (using 2019 nickel production numbers as a baseline) to reach the required nickel amount needed to phase out fossil fuels.

For lithium, 1,386 million tonnes are needed. In 2019, 0.086 million tonnes of lithium were produced. So it would take 16,121 years (using 2019 lithium production numbers as a baseline) to reach the required lithium amount needed to phase out fossil fuels.

For cobalt, 319 million tonnes are needed. In 2019, 0.144 million tonnes of cobalt were produced. So it would take 2,213 years (using 2019 cobalt production numbers as a baseline) to reach the required cobalt amount needed to phase out fossil fuels.

For graphite, 13,217 million tonnes are needed. In 2019, 1.1 million tonnes of graphite were produced. So it would take 12,015 years (using 2019 graphite production numbers as a baseline) to reach the required graphite amount needed to phase out fossil fuels.

For silver, 3.2 million tonnes are needed. In 2019, 0.0265 million tonnes of silver were produced. So it would take 121 years (using 2019 silver production numbers as a baseline) to reach the required silver amount needed to phase out fossil fuels.

When it comes to electrifying our vehicles, homes and power grids

the situation is super simple to dissect. These three bullet points say it all.

Global mine supply is in a downtrend.

Global industrial demand is in an uptrend.

Just like the move in lithium (13-fold increase) you have to be positioned before the stampeding herd gets there.

Video Feature with Electric Royalties CEO Brendan Yurik